Another indicators

A trading robot is a program operating in the terminal by the user-defined algorithm. A bot can replace a trader’s work if it is managed partially or adjusted according to the decision-making conditions. It allows not to do the routine work, for example, to open and close orders, monitor schedule, etc. Having set up all configurations, a trader can just observe the situation from time to time.

A trading robot is a program that performs operations in the terminal according to a user-defined algorithm. The bot can replace a trader's work, while he will manage it partially, or just adjust the decision-making conditions for the robot. It allows to not engage in the routine work (for example, closing and opening the orders, tracking the graph, etc.) as well as to control the work occasionally, having set the program once.

The Forex market is truly the most popular and profitable trading platform in the world, which automatically makes it attractive for people and the large investors, in particular. Forex has no physical location; there's no place you need to go to make deals, it works through the Internet and is available 24 hours a day. Moreover, the currency operations don't imply the supply of goods, and this is another plus in favor of the currency exchange.

However, trading on the Forex market is not an easy task. It is necessary to analyze vast amounts of information constantly, to forecast the price fluctuations, navigate the world news, etc. Sometimes, to get more profit, a trader must quickly react to the market changes, and this requires a serious preparation.

It's difficult to be up-to-date constantly, and so, to open profitable trades, without any assistance outside. To automate the work, traders use auxiliary mechanisms that facilitate the price analyzing process and market positions in general. Such efficient assistants are the Forex trading indicators or the robots.

What are the Forex indicators?

The primary task of a trader working on a currency exchange is the analysis and forecasting of the price fluctuations. This task is rather complicated, because of only a detailed and comprehensive study of the trend, as well as its frequency and direction, makes it possible to understand the situation as a whole. For complete information, it's necessary to consider several time intervals, determine the exact trend and calculate the optimal points to enter the market. Independent work will not yield great results, and experienced traders understand it.

Using the automatic systems simplifies the technical analysis and allows you to make a right decision about entering the market and opening or closing an order. Due to a specially built-in algorithm, the trading indicators determine the trend direction for the selected currency pair and signal about the moments for a trader to enter the market, getting the greatest profit. The signal moment depends on a type of the technical instrument chosen, and the trading strategy. It is recommended to use several indicators in parallel, to obtain the most accurate data.

Robot types

There is a lot of Forex-bots - some of them are built into the terminal, some are installed separately. Many trading robots have similar functional features. To understand which is perfect for you, you must test the tool on a particular strategy first.

According to the technical analysis basics, it's known that the market can be only in one of the next conditions: trend or flat. Accordingly, the indicators are also divided as follows:

- Trend indicators that determine the trend and its direction;

- Oscillators that work effectively in the absence of a market trend, or when the trend is poorly traced.

Also, there are the psychological indicators, which determine the market participants' mood. In combination with the robots above, they correct the trader's expectations and allow you to make a high-quality forecast.

You can download the most popular and effective Forex trading robots for MetaTrader4 for free on the MTDownloads website; also here you'll find the detailed characteristics for each indicator, as well as the installation and application instructions.

How to use the technical tools correctly?

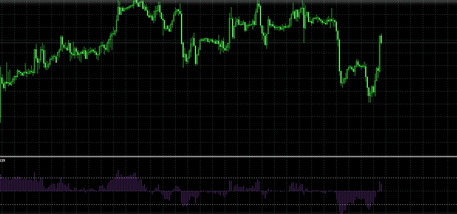

Modern trading platforms, and especially the most popular one - MetaTrader4, have excellent opportunities for the technical analysis tools work. In the MT4, there is a separate window for building graphs with its vertical scale, and there is also the possibility to impose the indicators on the current price graph. It allows you to test various indicator applications, and also do it autonomously, without overloading the price chart. You will find the most famous trading robots, that can be downloaded for free and installed on the Metatrader4 terminal, on the MTD website.

If you've found a useful indicator, please, don't forget that its single application is not recommended. Spend a little more time to find a robot for a couple, don't be lazy. Simultaneous use of several bots increases the probability to obtain an actual data, because, otherwise, you can get a false signal. Apparently, the use of the paired robots will allow you to reinsure yourself before making a decision, to open a profitable deal.

Another good advice on the use of indicators is a pre-testing. You can download the robots for free on the MTDownloads website. In fact, many portals offer to buy them. And if you won't check them in combination with your trading strategy properly, then you will make an unnecessary investment.

In conclusion, we want to say that the best tool for the successful trading on the Forex market, is a cold head and calculation. The foreign exchange market is a very shaky ground, and changes occur almost every second. Technical tools, such as robots, will help to analyze the price movements, they will “prompt” when it is better to enter the market, but, anyway, you need to act carefully, not relying entirely on the computer algorithm.

English

English

русский

русский