Average True Range (ATR)

The ATR indicator was developed in 1978 by Wells Wilder, the well-known trader and technical analysis guru. The original ATR purpose was to determine the volatility of the commodity futures market, but soon it was used to trade on Forex. The actual average range is not used to predict the direction of the price movement but only allows to estimate the market volatility degree. ATR does it well, that's why it's included in the most popular volatility indicators list, made by MTDownloads.

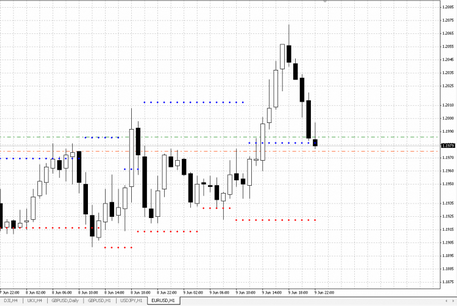

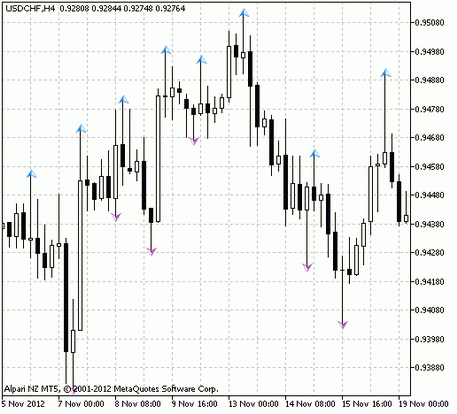

Graph of the ATR indicator

On the chart, the ATR indicator looks like a moving average curve, that fixes the price change degree for a specified time interval. With the ATR, you can determine:

- The difference between the previous closing price and the maximum of the current session;

- The difference between the previous closing price and the minimum of the current session;

- The difference between the minimum and the maximum of the current session.

Usually, a 14-period graph is used to construct the ATR. However, depending on the trading style, each trader chooses a time range that is most convenient exactly for him. If you take a less than 14 periods schedule, then the indicator will be more sensitive to the recent price moves, which will allow you to receive trading signals faster. However, the more periods the graph displays, the more accurate these signals are, since market noise and minor corrective movements are eliminated.

How to use the ATR indicator

Determining the volatility degree with the ATR indicator is very simple. You need to trace how the moving average line moves: if it starts to rise, then the volatility will grow; if the ATR line on the graph falls - then the market volatility will reduce. When the indicator line moves horizontally (traders call these moments “the calm before the storm”), that means the forces consolidation for the subsequent active movement.

Thus, the lower the indicator is in the graph, the more quiet trade is waiting for you. And vice versa - if the indicator is at the top marks, then the trade will be intensive. If ATR data shows low values for a long time, it can be assumed that the market is consolidating, and soon it's possible to turn or start a sudden move.

You can also predict possible reversal points, using the ATR indicator. For example, if you see that for 14 days the price has been fluctuating in the 70-points range, then the chance for it to go beyond these limits, during today's session, is minimal. Therefore, when the current trend has already overcome 65 points, then you expect it's coming to an end. Knowing how high the currency pair volatility was over a period also allows you to determine the stop-loss placing points.

Since the real average range was not designed to build any forecasts, it's only usable in combination with other indicators, which you can download for free on the MTDownloads website. It means that the ATR is not a basic, but an auxiliary technical analysis tool.

The ATR indicator in trading strategies

The actual average range is an integral part of such popular trading strategies as Turtle or Chandelier Exit. The correct average range is also used to search for divergence, that is, the price and indicator graph discrepancy. An example of such a difference is the situation when new highs are formed on the price chart, but the indicator decreases. This case signals that traders lose interest in this trend, which means that it possibly will end soon.

It should be noticed that the actual average range, like the other volatility indicators, is not able to predict the direction or the duration of the price movement. It only reflects the general activity that is present on the market at the moment. Although with its help you can determine the likely points of the trend reversal or the new movement beginning. The higher the indicator is in the graph, the greater our chances for a price reversal are, and the lower is its position, the lower is this probability.

Advantages and disadvantages of the ATR indicator

Using the actual average range for the technical analysis, you need to consider that it works late or reflects the previous volatility level for long periods. Therefore, it's recommended to use this tool in a range that doesn't exceed 20 periods.

Also, the ATR indicator doesn't give accurate trading signals, but only general information about the market activity, which isn't enough for a full-fledged trade. Therefore, the actual average range should be used only together with the other technical analysis indicators.

Advantages of the ATR indicator include its simplicity in use, as well as visible market activity image. For this reason, this technical analysis tool is trendy both among experienced traders or novices. To understand, if this indicator is suitable for your trading style, it's recommended to test it first on a demo account by downloading the ATR indicator on the MTDownloads website.

English

English

русский

русский