Turtle

The Turtle strategy is a trading method born as a result of the dispute between William Eckhardt and Richard Dennis. The first argued it was not enough to have the trading knowledge and practice it to be successful in Forex. Additionally, you need to have intuition. The second participant of the dispute insisted that only strict adherence to the strategy would bring a lot of money. In the end, Richard created a trading scheme due to which even a beginner can earn a lot of money.

Below we will tell about the peculiarities of this trading technique. On the MTDownloads website, you can download the trading robots that support the strategy of Turtles for free.

A bit of history

This trading strategy is the most famous in the world without exaggeration. Richard Dennis has proved its efficiency since the technique allows traders to get their deposits back and earn a lot of money for almost 30 years.

According to the source, the author has invited 13 people to take part in this experiment. Some of them were already familiar with the currency exchange, while the others did not even have a clue what it is. This group earned approximately 80% of the capital having adhered to the strategy of turtles for more than four years. By that time, the most successful students already kept a million dollars on their accounts.

Regarding the name of this technique, there are two opinions. Some argue the Turtles got this name because the dispute took place in the turtle farm. The others argue it is due to the slow growth of income compared to these animals. This experiment lasted for 4.5 years.

Entry rules

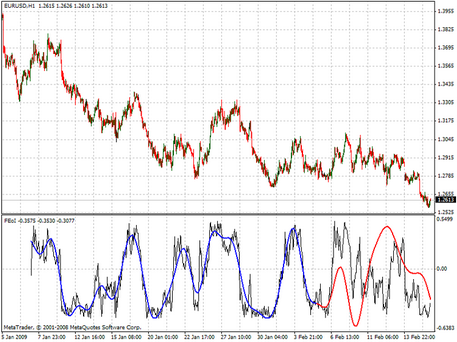

The strategy involves two options of market entry: the 20 and 55-day period. The figure below represents both options.

Before you start trading, you need to decide on a financial instrument, which should be preferably highly volatile. Use D1 timeframe. For example, take the current time on the chart, count 20 candles back, and open a transaction.

When you enter the market with a period of 55 days, the number of days will be changed for 55 candles back from the current moment. Below we will describe a strategy for 20 days, but you have to remember that the options differ only in the period.

For clarity, draw two horizontal lines through the extremes of the twenty-day period. Perceive them as the critical levels.

Here we must warn you that the Turtles strategy has already managed to gain immense popularity. Due to this fact, the author has restricted the public information regarding the open positions. However, traders have developed two schemes:

- open an order when the price touches one of the key horizontal levels shown in the figure above;

- open an order in the breakdown of one of these levels if the candle was closed beyond the price level.

The first is the most traditional point of view so that it will be considered.

- When the price rises to the level of the upper horizontal line, you need to buy the asset;

- If the graph descends to the level outlined by minimum extrema, it is time to sell.

How to close trades?

The author did not adhere to the method of take-profit order, but he developed conditions to fix result the trading result if they are fulfilled. But here we must mention the difference between the 20 and 55-day periods.

Closing the twenty-day period position, a trader needs to consider ten trade days. In the case of 55-day, 22 days are in reserve. We will still analyze the first option.

If we talk about the buy order, then the price goes down, and you have to observe this process for ten days. After this time, determine the maximum price for the trading period and draw a horizontal line through it. This line is a fundamental level, and if the price reaches it, the trade will be closed.

If you see the price never broke through this level, take the similar actions in ten days. When closing a buy position, use the same algorithm.

Conclusion

In this article, we describe highlights of the Turtles strategy - one of the most profitable trading methods in the world. At the MTDownloads website, you will find a complete list of trading robots designed to support this unique system. Setting up each of the indicators is not difficult, besides, the website describes the procedure in details. All programs are represented in their last versions.

The Turtle strategy was designed for use in the stock market; it is one of the most popular techniques in the foreign exchange market. It's time for you to test it in practice!

English

English

русский

русский