Chandelier Exit

Chandelier exit is a traditional strategy in Forex trading based on the analysis of volatility using ATR. In fact, this trading system is a type of trading stop. Its purpose is to protect profit until the transaction remains open. You will learn more about the features of Chandelier exit strategy later.

Most of the technical tools are set up to help the trader to enter the market correctly, as well as to facilitate the trading process. This fact is the one the newcomers focus on, which is important to open a profitable deal. But here is the problem: very few people think about the correct exit from the market, and we will unfold this secret below.

The goal of any trading strategy creating is the trader's desire to keep the money, and the key to success is to determine the right moment to open an order. Of course, it's still important, which kind of deal to make - i.e. to buy or to sell an asset. However, when a critical situation occurs and a trader observes losses on the graph, his thinking turns off, and he rushes to end the loss-making trend. Therefore, you need to think not only about the ways to enter the market, but also the methods of completing the trade without missing the investment.

Exit the market

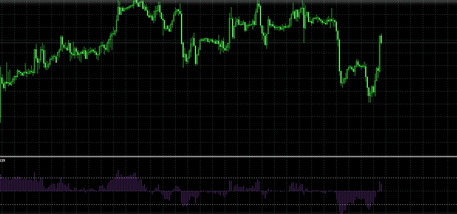

Chandelier Exit is one of the most attractive exit strategies. The name comes from the graphic arrangement of the order closing the trading position, it's always located at some distance from the highest point of the market, and as a result, it looks like a chandelier.

When an order is open, it's necessary to think where the stop must be set. In fact, stop-loss is displayed at a level that a trader considers to be minimal for the transaction, and when the price reaches this mark, this deal will be closed automatically. Choosing the stop is extremely important since this avoids unexpected losses.

Apparently, the adherents of this system place a stop at the distance of several mid-ranges (ATR) from the highest market point. You can also rely on the highest bar closing, fixed since the opening of the deal. The logic is simple: the maximum will only move upwards, and the stop placed this way either remain in place or moves next.

Uniqueness of the system

The Chandelier Exit allows you to keep the position open almost until the end of the trend because the stop will only work when there are serious prerequisites for the trend to reverse. A significant contribution to such a strategy creation was made by Dr. Van Tharp, a trader, who showed that with such a system it is possible to enter the market at any moment, and the trade will remain profitable for a long time.

The uniqueness of the ATR is the adaptation for the market volatility, and its work will still be exact, regardless of the instrument, or a price. The most efficient ATR use goes from 2.5 ATR to 4 ATR.

Using the Chandelier Exit

The Chandelier Exit is used most effectively in trend markets since the stop follows exactly the trend. In fact, this mechanism is even greater than the entering ways - we have already pointed out that the profitable long-term trade is ensured with a proper ATR placement. This strategy is perfect for those who plan to invest in currency fluctuations for a long time - a year or more. With the short periods, the work should be done carefully.

If you're going to enter the market, you must determine the exit options both if the transaction is successful, or if the result is unprofitable. If everything goes just as you've expected, the Chandelier will move up along with the price line movement. The research of Chuck Lebeau and Terrence Tan, the currency exchange trade experts, proved that placing large initial stops increases the number of winning trades. However, you must do this carefully. So, if you follow a strategy with high stops for a long time, you can get some losses, in case there were several profitable positions in a row before.

You can also rely on the fact that Lebeau and Tan recommended a 50% drop in stops after a few days of trading on the Chandelier Exit strategy, which will increase the number of winnings.

Alternative exit

A sufficient option is to set break-even points concerning support and resistance levels. In an extended trade, focus on closing below the support level, and for a short trade - above the resistance level. At the moment of these positions overcoming, you will have an opportunity to choose: keep trail the established stop further or close on profits.

An exit system based on the intersection of moving averages (MA) is very efficient too. Here you can close on the signal opposite to the one you've entered the transaction. For the sake of safety, some traders put an extra time stop, suggesting which period the trend will turn over. The longer the trade lasts in a single direction, the higher is the probability of the reversal.

English

English

русский

русский