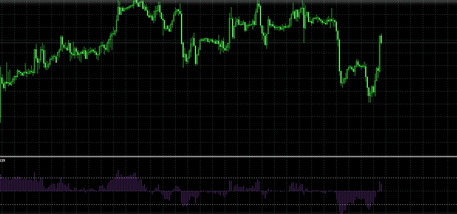

Cycle Indicators

One of the primary currency market laws says that history repeats itself. It means that it's necessary to analyze its behavior in the past to predict the price movement direction in the future. Therefore, specific indicators for technical analysis have been developed. They explain price movements of the past and generate signals that allow traders to decide on buying or selling the asset.

Cyclical Forex Indicators include Elliott Wave, Schaff Trend Cycle, the Detrended Price Oscillator (DPO), Wolfe Waves, and many others. You can find each one of them on the MTDownloads site. You need to familiarize yourself with the cycles concept in financial markets to better understand how these tools work.

Forex Cycles

You can observe periods in all the life spheres. Financial markets are not an exception. A cycle is a continuous, repetitive motion with a constant return to its original state. Thousands of traders use periods to build their trading strategy based on the repeatability of the price movements. The theory of cycles formed the basis of many profitable Forex strategies. There are time and trend cycles in the currency markets.

Time cycles of currency markets

There are several types of time cycles in Forex. Each of them has its peculiarities:

Seasonal cycle

Depending on the season, the price volatility changes for any financial instrument. In summer, the general market activity is reduced, so many traders prefer not to trade during this period.

Monthly cycle

The large financial structures and state institutions perform certain actions every month or timing them to specific dates. They publish reports, carry out large-scale trading operations, etc. Markets usually stay in standby condition before such events, and their activity is reduced. Afterward, there are sharp movements and volatility bursts.

Weekly cycle

At the beginning of the week, the markets are usually less active, because at this time traders evaluate the news coming out over the weekend and the other participants' reaction to them. On Friday evening, there is an increased activity of the markets as at this time weekly trading results are consolidating.

Daily cycle

There is a change of several trading sessions during a day in the Forex market. Accordingly, the activity of trading currency pairs is changing. For example, the Japanese yen is most actively traded during the Asian session, and the Swiss franc is traded during the European session.

Trend cycles of currency markets

The market seems to be chaotic at first sight. However, certain regularities characterize the formation and the development of the trend. Trend cycles are the basis of the wave analysis. The theory of waves says that the market is impulsive, and after every impulse, a rollback occurs. Thus, several cycles of the trend are singled out:

The origin of trend

It is the first stage in the trend formation, which is preceded by the relatively calm market. At this point, market participants are consolidating their forces. In other words, the market is in flat, in a state of the calm before the storm. After that, there is a sharp move up or down, which is accompanied by a breakthrough of the levels of support or resistance. This phase is uncertain because nobody knows whether the trend will continue or will be corrected in the opposite direction.

Trend growth

At this stage, a trend grows. At the beginning of the trend movement, you can observe the price attempts to roll back to the penetrated level. However, if a trend is particularly strong, there can be no retreats.

Maturity of trend

This stage is characterized by the attenuation of a trend. Bulls or bears, which pushed the trend forward, are already exhausted, so the rapid growth begins to stop. At this stage, patterns that indicate the end or turn of the trend ("Double top," "Double bottom," etc.) can be formed.

Trend's aging

The final phase of the trend existence, when the price begins to turn in the opposite direction. After this, the next cycle begins with the repeat of all the previous steps.

Keeping trend cycles in mind, you can enter the market at the right time and make the profitable trades. The cyclical indicators help determine the stage of a trend. They can be downloaded for free on the MTDownloads website.

Forex cycles' features

The Forex market cycles are asymmetrical; duration of the cycles is not the same. Besides, cycles can be shifted in different directions; their length can vary. Therefore, all traders who use the wave theory in their strategies are forced to improvise. Those who believe that reversal points will exactly match the cycles found often make mistakes in trading.

Even if a trader has already considered the cycle as the most appropriate to the current market situation, it doesn't mean the reversal points will be in the same place as the last time. Therefore, it's not enough to rely on cycles in the Forex market analysis. You need to check your forecasts with the help of trend indicators additionally. You can find more details about them on the MTDownloads site.

English

English

русский

русский