Momentum

The Momentum Indicator is a technical indicator for Forex trading, which belongs to the class of oscillators. This tool delivers signals leading the current market situation and therefore serves to generate the accurate market forecasts.

This tool is used by traders to obtain an objective picture of the trend behavior during the analysis, and also as an outrun trend indicator.

The Momentum is used on any time frames within transactions with currency, binary options, and stock assets. This tool shows the greatest effect on the long time frames. However, it can also be used for short time intervals, trading against the trend movement direction.

Features of the indicator

Signals are shown below the main price chart in a separate window. The signal looks like a curved line, which either moves toward the trend or outruns it.

The signals of the Momentum indicator are based on the closing prices of the first and last candles for the selected time interval. The default period is 14; this value is classical for most oscillators. The trader can also change the period, for example, increasing it to work on the long time intervals. However, it is worth paying particular attention to the characteristics of the instrument used. Otherwise, the accuracy and timeliness of the indicator signals may deteriorate.

As a rule, the indicator signals with high precision, but we recommend to compare it, just like any other instrument, to another tool to exclude the false signals possibility. For example, you can use the moving averages or trend indicators.

The Momentum performs the following primary functions:

- Determines the dynamics on the market in the future;

- Identifies the market direction.

Typically, this information is sufficient to ensure that a trader chooses the correct points of the position opening as well as the active exit levels.

Setting the indicator

Several parameters adjust the Momentum indicator:

- The period on the 'Settings' tab is 14 by default, but it can be changed by the user for a particular trading strategy;

- The 'Levels' tab is responsible for the range the indicator is displayed in. Most traders set this interval from 100 to -100;

- On the 'Display' tab, it's possible to adjust the colors of the line and interface.

The Momentum Indicator in use

Several indications can be identified during the indicator operation cycle:

- If the line of the indicator crosses the level of 100 from bottom to top, it means a strong bullish trend, and, accordingly, an excellent opportunity to buy an asset;

- If the line of the indicator crosses the level of 100 from top to bottom, it means the presence of a bearish trend and the right conditions for sale;

- If a jump occurs in the indicator readings with a sharp move in the opposite direction - this means the level formation will act as a significant resistance;

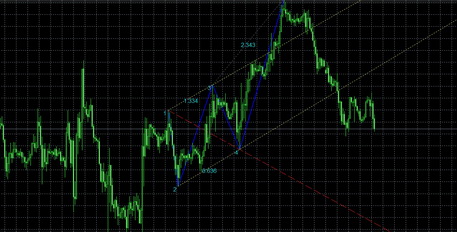

- Divergences on the chart mean the end of the trend. The trader can also observe the classical divergence figures, such as bearish and bullish divergences as well as convergences.

There is also a divergence including a horizontal price line and a diagonal curve of the indicator. It means a weak trend and a high probability of its further reversal.

It should be used at the moments when its curve moves in the trend direction in conditions of the high market volatility. Experienced traders can also use this tool against the trend movement, setting the additional levels that act as boundaries of the oversold and overbought zones.

Summary

The Momentum Indicator is a powerful technical analysis tool, which can be used within various trading strategies. The indications of such a tool give a trader all the necessary information to successfully open a deal and successfully exit the position as well.

However, it should be noted that, just like all the oscillators, this indicator can deliver wrong signals. Therefore, it's recommended to use it along with the other tools, for example, trend indicators or moving averages. By verifying the Momentum readings with the data of other indicators, the trader gets the opportunity to check the signals, and so to determine the forecast with accuracy.

The tool is easy to set up. However, it requires the trader to understand the trading strategy. For beginners, it's recommended to get used to it on a demo account before applying the Momentum indicator to a real trading.

English

English

русский

русский