Average Directional Index (ADX)

The Average Directional Index, or the ADX, is a popular indicator that is used for technical price analysis in the Forex financial market. The ADX can effectively determine the presence of a trend in the financial market or the absence of changes in the price movement. The indicator was developed by Wells Wilder who wrote a book about working with this program. The program is developed from 2 predecessors – the Positive Directional Indicator and the Negative Directional Indicator. The positive indicator captures the movement strength of the trend growing, while the negative indicator shows the power of the falling trend movement. The ADX indicator has combined the functions of +DI and -DI smoothing them with the moving average.

Use of indicators for the stock exchange work is widespread today. It is not a surprise because these tools help make trading efficient and profitable. Many traders use programs like an Average Directional Index.

How is the ADX metrics calculated?

The average direction index is calculated using the simple formula: ADX = SUM ((+ DI - (-DI)) / (+ DI + (-DI)), N) / N

Abbreviated characters values:

- N - the number of periods used for the calculation;

- The symbol SUM (..., N) is the total amount for the N-th number of periods;

- + DI - a sign of the positive trend indicator;

- The -DI symbol denotes an indicator of the falling price negative direction in the market.

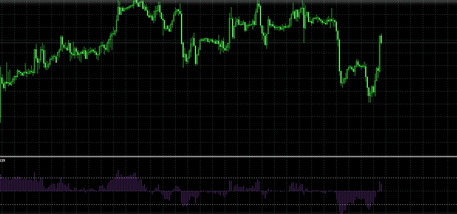

Running the program, you will see several color lines on the screen. The first, blue line, is the positive indicator +DI. The red color is negative -DI. And, accordingly, the dark green line is the index of the average motion direction. When the ADX line moves upwards, it means that the trend has started to grow. You can buy shares at the moment when the blue line rises above the red one, while the indicator will also move in a growing direction.

You can fix your profit when you notice that the blue line + DI is set above the -DI, while the dark green line begins to lower its level. On the contrary, the moment when the + DI line is dropped below the -DI level, and the ADX line grows shows that it's a time to sell the shares. If you see that the +DI is below the -DI level, but the ADX indicator line is also moving downward, this means that the ADX indicator is giving you a trade signal that indicates that the financial market is "overheating." It's time to fix the profit.

How to use the program?

The ADX indicator helps traders correctly determine:

- the presence of a trend in the financial market;

- the right time to open a purchase position for shares;

- the optimal time to sell the shares;

- the moment when it's necessary to fix the profit.

How to interpret the ADX metrics?

- The indicator line has dropped below 20: the trend is currently absent in Forex.

- The line stopped at the level of 20: this is the correct system signal about the new trend direction. You can consider the probability of buying or selling stocks in the direction that prevails.

- The indicator line is fixed between the numbers 20 and 40: it's the other confirmation of the other profitable trend's emergence. You can buy shares or make a profit by lowering the value of shares or currencies in the trend direction. Try to avoid using the oscillator program and pay attention to such an indicators as the moving averages.

- The line has risen above the level of 40: the trend is solid, the probability of a reversal isn't great.

- The indicator has increased above 50: you see an incredibly powerful trend.

- The intersection of the line above the level of 70: it's the strongest trend, which is relatively rare.

Advantages and disadvantages

The indicator is handy for any trader. The correct definition of the market situation at the moment is always relevant. Knowing whether there is a trend in the Forex market, or there's no tendency to its emergence allows a trader to predict the increase in profits correctly and to avoid mistakes that lead to a loss.

The ADX indicator is an ideal addition to the other kinds of technical indicators. It combines well with the moving averages. The Moving Average and the derivatives of this indicator are highly efficient in the market, but when stock prices fall/rise and don't have a clear direction, the moving average indicator can give a sufficiently large number of wrong signals to buy/sell. It is always associated with a high risk of financial loss. Apart from the MA, the ADX is perfectly compatible with all oscillators. Trading with these two programs is extremely useful in the non-trend markets.

Like all the technical analysis programs, the ADX has its drawbacks.

Sometimes indicators can be displayed with a little delay. Also, there may be so-called spikes. This inconvenient problem usually occurs when the indicator is used at a time the trading position is open for an extended period. Spikes often happen at the moment of transition from a long-growing trend to a falling one, and vice versa. Also, the ADX is often unable to fix turn in time, when there is another trend in the opposite direction, since the data calculation moved in the same direction during the last time is taken into account.

Features and differences from the other indicators

The main characteristic of the ADX program is working in advance. It effectively shows the trend's strength. When the indicator is used for a period of 14 bars, traders usually notice the following. If its upward movement changes to a level of more than 0.25 comparing it with the previous bar value, it's possible to conclude that the trend direction will remain the same. When the indicator changes by more than 0.5, it means that the current trend is powerful. It should be noted that the most long-term and powerful trends make this trend indicator keep a level more than 1, at the beginning.

If you want to make your currency market trading advanced, try to work with the ADX! Download the program right now and start increasing your profits significantly!

English

English

русский

русский