Heiken-ashi ZoneTrade

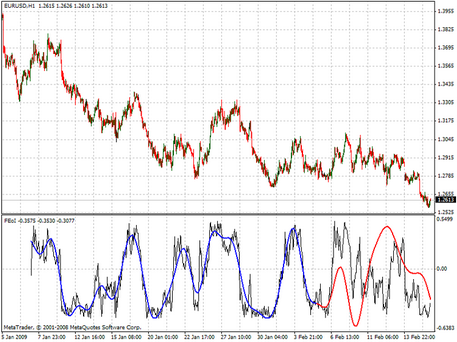

There are a lot of Forex strategies that have already been studied from all sides. For a trader who hasn't been familiar with it before, it may seem like an ordinary candlestick graph. It doesn't have displays anywhere on the chart; it isn't shown as a line, which is a little strange. It allows you to transform the Japanese candles and presents them in order. The Heiken Ashi gained popularity mostly due to the ability to smooth the price fluctuations as well as making them trendy and more fluid. Among the active traders, it got the most distribution due to the abilities. Also, it became trendy among the experienced users.

Where and why is it used?

A standard candle graph displays the opening and the closing of the price, the maximum, and the minimum, sorted by time and price. The Heiken Ashi, through a particular averaging system, allows you to smooth the price graph and makes it more understandable to analyze. The calculations are based on:

- The opening level, which is the average price between the opening and the closing of the previous candle (close + open / 2);

- The closing level, which is the average price of minimum, maximum, opening, and closing of the current candle (min + max + open + close / 4);

- The maximum, which is the highest price value among opening, closing, and maximum;

- Minimum, which is the lowest for opening, closing, or the current candle minimum.

What is the advantage of such a formula? What can this calculation give? Each candle of this indicator smoothly flows into the previous, or the next one. It creates a bright but smooth fluctuation graph. At the output, this formula gives a clear view of the changes, which allows the further development prediction.

Candle types

In total, the Heiken Ashi includes five candles. They identify the trend and open the position:

- A green candle with no shadows marks a strong ascent movement. It is a direct signal to hold the position; it's necessary to allow the profits to keep growing.

- The regular green candle usually appears at the beginning, or at the end of the nascent movement. It's a signal to close a short position. It's also recommended to go for a long one.

- A candle with a short body and long shadows indicates a possible change in trends. During the buying operations, it's recommended to pay attention to the downward movement, which is displaced by a green candle. You shall make a purchase. For sales, you shall follow the reverse policy.

- When a red candle appears, act opposite to the paragraph 2.

- A red candle without an upper shadow requires the reverse actions to the ones specified in paragraph 1.

The ground rules for the indicator use were given above. There are many different tips for this graph applying, and below are the main ones.

Basic tips to use the indicator, its advantages, and disadvantages

First, it is worth to see all the positive aspects of the Heiken Ashi, as well as its drawbacks. The most significant plus is a possibility to determine the trend with the maximum clarity, without any interference and other "noise" that makes the trend difficult to understand. The main drawback is that this trend indicator, just like the others, is lagging behind. If you want to study the indicators better, you should go deeper into the "Technical Analysis of Indicators."

The main reason to use the Heiken Ashi ZoneTrade is a rollbacks trading. The position opens in the standard graph, after that it's necessary to go to the Heiken Ashi. Beginning traders often make the same mistake. As a rule, they hold the position too long or close it too soon. Of course, this leads to the least profit, or even to losses. The Heiken Ashi indicator, due to its lag, keeps the deal as long as it could be needed.

Features of the Heiken Ashi ZoneTrade

Looking over the information above, it becomes apparent that the indicator can be an excellent trading tool. With the right use of it, having the information about all the additional functions, such as oscillators, the Heiken Ashi can become an excellent assistant. Like any other indicator, it doesn't contain trading signals. It can lead to a loss of capital. It should only be used to maintain a position and to display the current trends.

English

English

русский

русский