Williams’ Percent Range (WPR)

On the graph, the Williams' %R looks like a dynamic line in the bottom of the active window, which moves in the range from 0 to -100. Indicators are formed the same way as a stochastic one; the only difference is that the Williams' indicator values are calculated on an inverted scale. Below we will consider the application mechanism for this trading robot in details.

Technical indicators are one of the primary trading tools of the foreign exchange market. In the 80's, the well-known trader Larry Williams developed a robot that allows you to determine the area of an overbought or an oversold asset, as well as the possible trend reversal points. This tool is still used, and it's called Williams' Percent Range, abbreviated to %R.

The indicator helps to identify if prices have risen too fast and high, so there will be a decrease in the value of the assets (overbought) soon, as well as to reveal a sharp price drop, after which the level will necessarily increase (oversold). It's recommended to use this robot along with such oscillators as MACD, Stochastic, RSI, etc. To test each program, download them for free on the MTDownloads website.

Description of the Williams' %R

The algorithm of the tool is based on defining the closing prices and the minimum prices for the selected period. Depending on this, the program signals the price transition through the level of oversold or overbought, respectively.

It should be noted that this tool responds quickly to any changes in the market volatility, so the traders receive up-to-date information without inaccuracies. It allows you to respond in time to the level dynamics and to keep your investments. At the same time, the WPR shows excellent results on any time frames, which makes it almost universal.

Concerning the time frames used, a lot of tests show that the Williams' indicator is better on the long time periods. The matter is that the price often behaves unpredictably in the narrow corridors, which can provoke traders to make impulsive trading decisions and have losses.

Indicator settings

The algorithm of the tool can't be changed manually (unless you are a programmer and can rewrite the program code), only the period will be able to vary. Mr. Williams claimed that this indicator generates the greatest number of potentially profitable signals and gives no false indications. To test the robot, the trader can change the specified parameter, which directly affects the sensitivity of the indicator to the price trend.

- With the increased period, the program will begin to signal with a delay, reacting to the market changes more slowly;

- If you set the period to less than a 14, the %R will signal the slightest change in volatility.

Using the WPR

The trading robots are usually created to support the strategy, or the strategy includes them. The strategy for the Williams' range indicator is also based on the instrument, and the rules are as follows:

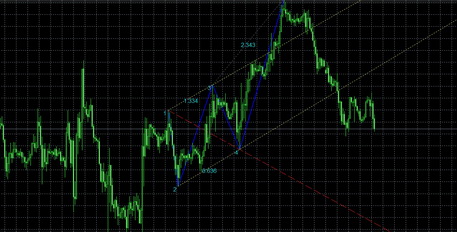

- You need to buy when the market is oversold (%R ≤ -80%) - the area is highlighted in green on the example below;

- You need to sell when the market is overbought (%R ≥ -20%) - the red area on the graph.

Oversold status is displayed on the graph when the line drops below -80% to -100%. The minimum formed indicates that the sellers are more active on the market. The overbought position is above -20% to 0%, and this means that the buyers are high at the moment.

Making trading decisions, remember to enter the market only in case of a price turn in the corresponding direction, since the indicator algorithm is set up to analyze certain time intervals only.

The Divergence Model

The indicator line doesn't always coincide with the price graph, and the trader must understand what that means. The difference between the price chart and the Williams' instrument shows that now the market is dominated by a weak trend. There may be the following situations:

- The instability of the uptrend is indicated by the price increase to the next maximum, not accompanied by the indicator growth;

- A weak downtrend is observed when the price falls to a minimum without the same movements on the graph of the technical instrument.

Advantages and disadvantages of the program

The Larry Williams' Percent Range includes the abilities that will be useful for traders who want to control their investments competently. The key ones are:

- Ability to integrate into any trading terminal;

- Possibility to adapt to almost any trading strategy;

- To generate clear signals and block false signals;

- Well-established work on any time frames.

The drawbacks include the uselessness of a directed trend work - this is a feature of all the oscillators. If the trend develops too quickly, the indicator may not react to such a strong push for some time or will give false signals.

English

English

русский

русский