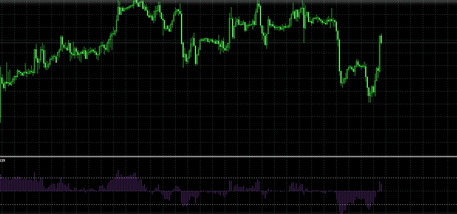

Volatility Indicators

Volatility is one of the leading indicators for the Forex financial instruments. The price forms the highs and lows for a particular period. Volatility is the distance between the highest and the lowest prices for a period.

High currency pair volatility indicates that this financial instrument is capable of getting a big profit. At the same time, along with volatility, the losses risk also increases as it's much harder to build a correct forecast in this situation. Therefore, it's essential for a trader to determine the degree of price activity for a particular financial instrument.

What does volatility depend on?

The market activity degree depends on many factors. Substantial fluctuations occur during significant economic and political events. Volatility usually falls when there is no relevant news. However, when important messages emerge, the price of a currency pair can overcome 100-150 points in just a few seconds.

Also, volatility of a particular currency pair depends much on the trading time. For example, the euro or the British pound is most actively traded during the European session, and the least volatility of this instrument is fixed during the Asian markets work. Consequently, the volatility indicator is affected by the number of market participants and the trade transactions volume that they conclude.

All these factors are reflected in price graphs, and they can be deciphered by the particular technical analysis tools, such as volatility indicators, which can be downloaded on the MTDownloads website.

Volatility indicators of a currency pair

The principle of such indicators operation is based on one of the key financial market laws, "The history repeats itself." It means that these instruments forecasts are built on analyzing the movement of the currency pair price in the past. The most popular volatility indicators include ATR, RVI, Bollinger bands, Chaikin Indicator (CHV), CCI, and many others available on the MTDownloads website.

Using volatility indicators, a trader has to choose the graph time range correctly. In the trading terminals, the default setting is usually a 14-day interval. However, this isn't the only option. Depending on the trading style, each trader can choose the time range that is most convenient for him personally.

If you take a period of fewer than 14 days, the indicator will be more sensitive to the recent price maneuvers, which will allow you to receive the trading signals faster. However, if you set 20 or more periods in the settings, the indicator will generate more accurate signals, since market noise and minor corrective movements are eliminated on such graphs.

Why is volatility measuring needed?

Most of the volatility indicators are curves moving in a range limited by the maximum and minimum price for the period. It's possible to predict the price movement in the future and possible trend reversal points with a high probability estimating such graphs.

Let us suppose the price volatility is 120 points for a day, and this situation is repeated throughout the last month. Watching the price at a particular moment, we see that it has already passed 110 points. The chance that the price will move further than the 120 points mark is minimal. It is possible only if some important news will be released in the nearest future. If nothing like this is expected, then most likely, the price will turn soon. Therefore, we should wait for the trend reversal and prepare to conclude deals by the new trend.

Another situation. We see that the price on the graph was 80 points for the week. On Tuesday, the currency pair has already overcome 10 points. Therefore, we can assume that if the price continues to move along the usual trajectory, it can pass up to 70 points. To reduce risks, you can set the stop-loss at the border level.

How to measure volatility?

The easiest way to estimate the market volatility is to apply technical analysis indicators that are included in almost all trading platforms' standard set. You can also download the volatility indicators on the MTDownloads website for free. Before their invention, volatility was measured using a special formula or by measuring each candle on the graph, then dividing the resulting amount by the total number of periods.

The standard method calculates the so-called historical volatility. However, there is also such a thing as the expected volatility. It is necessary to take into account not only the data obtained with the help of the formula but also factors such as:

- The market liquidity of the considered trading instrument;

- The economic and political situation in the country or region of interest;

- Day of the week and time of the day;

- The important news and rumors probability that may affect the trading instrument price.

As you can see, it is necessary to take into account a large number of factors to calculate the expected volatility as well as to be able to assess their impact on the currency pair price correctly. Therefore, almost no one uses such methods. Fortunately, all traders have technical analysis indicators and unique services that allow evaluation of volatility online.

English

English

русский

русский