Bollinger Bands

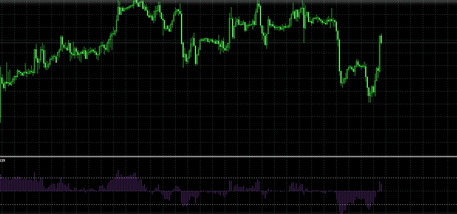

Bollinger Bands are among the most popular technical analysis indicators. This tool shows the market volatility, and it helps identify possible points of the trend reversal and the most successful moments for the long and short positions opening. You can learn this indicator and how to apply it on the MTDownloads site.

Bollinger Bands indicator settings

There are three simple moving average lines (SMA) on the Bollinger Bands graph. The upper band shows the maximum prices for the period; the lower one shows the minimum prices. There is a channel formed between the top and bottom bands. However, the price mostly moves within. The central line allows you to assess how high or low is the price at a particular point about the average parameter.

John Bollinger, the indicator's creator, recommended the following settings for this tool:

- For the middle band:

- 10 SMA - for short-term time frames;

- 20 SMA - for medium-term time frames;

- 50 SMA - for long periods.

- For the upper band, the standard deviation (-2) is recommended to vary depending on the time frame duration;

- For the lower band, the standard deviation (-2) is recommended to vary with the time frame duration.

Despite the Bollinger's recommendations, some traders still prefer to customize the indicator at their discretion. To understand if the standard settings are suitable for your trading style, try to test the indicator on the demo account first.

The Bollinger Tools

John Bollinger singled out several characteristics of the tool he created, which are designed to help traders make the right trade decisions.

- Graph movement started from one of the bands, mostly reaches the different band.

- Bollinger lines, as a rule, break no more than four candles in a row.

- If the distance between the bands for a long time is narrow, then soon it is necessary to expect a trend reversal.

- Saw-shaped movements inside the bands, which follow the same movements outside them, most often signal a trend reversal.

- Breakdown of the upper or lower band may indicate the formation of a new trend.

If you want to test these features in practice, you can download the Bollinger Bands indicator on the MTDownloads website for free.

Using the Bollinger Lines

Each trader uses Bollinger Bands at his discretion. Some prefer to buy when the price reaches the lower band and close the position after the price graph touches the middle band. Others buy immediately after the moment of breaking through the upper band price and sell if the price falls below the lower Bollinger band. If the price doesn't go beyond the channel limits made by Bollinger bands for a long time, the market is flat.

With this tool, you can also identify overbought and oversold markets, which allows predicting possible moments of a trend reversal. When the price approaches the bottom line as close as possible, the market is oversold. The product is currently traded at the lowest price, and if you buy it now, then you can expect to receive a solid profit when the price unfolds. The reverse situation is when the price approaches as close as possible to the upper band. It means that the market is overbought, then it's time to sell the asset since it's likely that now it's traded at the maximum price, which will soon begin to fall.

To identify volatility of the market with the Bollinger Bands, you need to pay attention to the distance between the lines. The larger this distance is, the higher is the market volatility.

Some traders use the Bollinger Bands as support and resistance levels. The upper line performs the resistance function, and the lower one supports.

The Bollinger Bands signals

Traders use patterns formed on the price graph to select the moment for the opening. The most famous models are the figures like “Double top” and “Double bottom.”

The “Double Bottom” visually resembles the “W” letter. It indicates time to open long positions. The signal is formed as follows:

- The price touches the bottom band or punches it.

- Then it turns and moves to the middle band.

- Next, the price turns again and forms a new minimum, without touching the lower band.

- When the price crosses the middle Bollinger band again, it's time to buy.

The “Double top” pattern, or the “M” letter, indicates that it's time to open short positions. The signal for sale is formed as follows:

- The price touches the upper Bollinger band or punches it.

- Then it starts to move to the middle band and turns;

- A new maximum is formed, which does not touch the upper band;

- When the price crosses the middle Bollinger band again, it's time to sell.

Traders usually use the Bollinger Bands with the Japanese candlestick patterns. If the emergence of the “Double top” or “Double bottom” figures coincides with the reversal patterns of the Japanese candles (“bullish absorption,” “hammer,” etc.), signals to buy/sell are amplified. More information about the patterns of the Japanese candles can be found on the MTDownloads website.

English

English

русский

русский