Puria

The Puria method is a Forex trading strategy of the scalping type. It is quite simple to apply and suitable even for the financial market beginners. They don't have to worry about choosing the tools or time frames - the strategy already provides certain time frames and take-profit levels for each particular currency pair, and the entire trading process is based on simple tools installed in the MT4 terminal by default.

The Puria strategy doesn't imply high take-profit levels but is designed for a stable daily income. Within the correct use, the system provides at least 50 profit points per day, during the intraday trading. We will take a closer look at the features of such a method, as well as the terminal settings, below.

Features of the Puria method

As mentioned above, this system provides the fixed time frames, depending on the currency pair selected:

- EUR/USD - M30;

- GBP/USD - M30;

- CAD/JPY - M30;

- NZD/USD - H1;

- AUD/JPY - M30;

- USD/CAD - H1;

- EUR/GBP - H1;

- USD/JPY - M30;

- USD/CHF - M30;

- EUR/CHF - H1;

- AUD/USD - M30;

- EUR/JPY - M30;

- CHF/JPY - H1.

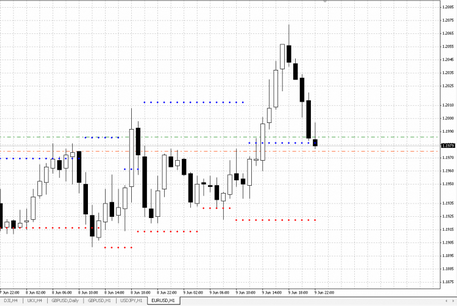

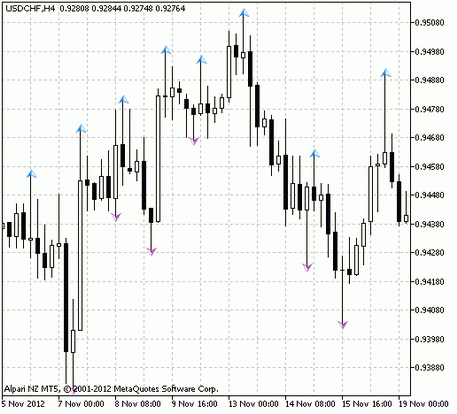

Three moving averages and one MACD indicator are used in the system - thus, a trader gets all the necessary tools to provide an accurate analysis of the current market situation, as well as to filter the false signals.

The first moving average is placed on a graph with a period of 85, using the Linear Weighted method. It's applied to the Low, the color of the moving average is red.

The second moving average has a period of 75, using the Linear Weighted method, it applies to the Low, the color of red.

The third moving average is the exponential one, with a period of 5, applicable to the Close, colored yellow.

The MACD indicator has the following parameters: fast EMA - 15, slow EMA - 26, and the MACD SMA - 1.

As for choosing a broker, then for this strategy, brokers with small price indents are suited best, so the trader could exit the market faster.

Trading with the Puria method

With such a scalping technique, it's easy for a trader to open profitable positions by checking the indicators data. With the necessary settings in the terminal, a user knows which signals should be expected in advance:

- Sale. A sale deal is open after the yellow moving average crosses both red lines from top to bottom. At the same time, the trader checks the MACD indicator - one of the bars should close below the zero mark;

- Purchase. A buy order is open when both red moving averages intersect with the yellow one from the bottom to top. The MACD indicator should display a confirmation, like a candle that closes above the zero mark.

Using the Puria strategy, the stop-loss points shouldn't be set higher than the level of fourteen or twenty points. It is caused by the fact that the transactions won't close on stop-losses, which happens extremely rare. There is also another way of setting the stop-loss: this level shall be fixed below the nearest minimum price, within a deal for the increasing exchange rate, or - at the maximum price, for transactions of the rate reducing. With such an approach, the level of take-profit should be set twice as high as the stop-loss level is placed.

However, the Puria strategy provides not only fixed time frames, but also the take-profit values depending on the currency pair chosen (all the values are explained in points):

- EUR/USD - 15;

- GBP/USD - 20;

- CAD/JPY - 20;

- NZD/USD - 25;

- AUD/JPY - 15;

- USD/CAD - 20;

- EUR/GBP - 10;

- USD/JPY - 15;

- USD/CHF - 10;

- EUR/CHF - 15;

- AUD/USD - 10;

- EUR/JPY - 15;

- CHF/JPY - 15.

Summary

The Puria method is considered one of the most efficient scalping strategies on the Forex. The simplicity of the approach attracts both experienced traders and the beginners, providing low-risk levels as well as a stable profit within the intraday trading.

This method doesn't require the additional tools installation, using only the built-in indicators of the MT4 platform, and relieves the trader of the need to calculate the appropriate levels of take-profit, stop-loss, nor the periods.

The accuracy of the Puria method is provided by using a combination of three moving averages along with the MACD indicator, which confirms the readings. Thus, a trader can be confident in his decision to open a deal for purchase or sale, and knows the minimum profit value in advance.

The effectiveness of the Puria method has been confirmed by hundreds of traders around the world, and anyone can start using it right after mastering the basic rules.

English

English

русский

русский