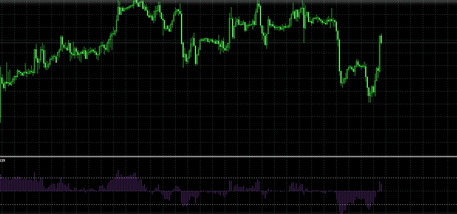

Double Exponential Moving Average (DEMA)

The moving average is the most well-known technical indicator used in the Forex market. It is a trend indicator, which forms an absolute average value of a trading instrument. Due to its "move," i.e. changes in indications over time, this analytical tool can ignore the "market noise" and smooth out the sharpest price fluctuations, which are not typical for a particular trading instrument.

At first sight, everything looks simple and clear. The first opinion would be right if there were no constant improvements of the indicator.

The specialized information resources report about the development of the new moving average modifications, regularly. All the changes relate to the algorithms of the averaged indicators calculating. To date, there are three types of moving averages:

- SMA (Simple Moving Average)

- EMA (Exponential Moving Average)

- Weighted Moving Average (WMA).

Each type includes several indicators.

Next, we will talk about one of the "youngest" members of the moving average family - the "Double Exponential Moving Average" (DEMA). The formula for this indicator calculation was presented in 1994, by Patrick Mulloy.

Features of the DEMA

The formula for this moving average calculation is as follows:

DEMAt (n) = 2⋅EMAt-EMAt (EMA), where:

the EMAt is the Exponential Moving Average by closing prices;

the EMAt (EMA) is the Exponential Moving Average for the values of the basic EMA.

In fact, the calculation formula contains double smoothing. Without going to the mathematical nuances, we note that the indicator calculated by the new algorithm has a shorter delay time than the usual exponential sliding.

The DEMA application in trade

The schemes of the DEMA use for the Forex trading, are a little different from the way other indicators of this group are used. Just as the other trend indicators, the DEMA is designed to "inform" the trader about the trend and its direction.

To generate trading signals, use two moving averages with different periods. The choice of the period depends on the time interval, at which the market analysis is carried out. Three main features can observe the presence of a trend:

- The moving average direction (up, down, sideways). For example, if the MA has a noticeable constant downward slope, this indicates a bearish trend. If it's upward, the trend is bullish. If the line doesn't have a constant inclination, it oscillates up and down; then there is the lateral trend (flat). The scope of these fluctuations allows us to assess the price band width.

- The position of the group of consecutive candles (bars), relative to the moving average. If they stand above the MA (regardless of its type), then the trend is bullish. If they are below the MA - the trend is bearish. On both sides - the trend is absent (flat).

- The position of the two moving averages with different periods, relative to each other. If the fast MA (with a smaller period) is higher than the slow one (with a longer period), then the trend is bullish. In the reverse situation - it's bearish. If both averages are intertwined and intersect often – it's flat.

The characteristics above are listed in the order from the fastest one to the slowest one (all other things being equal). For example, if the price breaks its moving average before the pair of moving averages cross (as the linear price chart coincides with the moving average having the period of 1).

- The mutual position of three moving averages. If three lines are in the right order, this indicates a trend. For an upward (bullish) trend, the correct order is when the fastest line (the one with the smallest period) is located above two others, and the slowest one (with the longest time) is below two others. In this case, the line with the intermediate period is somewhere in the middle. For a downward (bearish) trend - on the contrary, a fast line should be at the bottom, and a slow one - at the top. In the lateral trend, the correct order is violated, and the lines are randomly arranged. You can also use more than three moving averages.

- The moving average position relative to the price envelope (price corridor). If the MA passes inside the envelope and is far enough from its border, then there is no trend. If the trend is downward, the MA is near the upper edge of the envelope, or, even more so, outside the envelope, above its upper limit. Conversely, if the MA is near the lower edge of the envelope, or below this boundary, the trend is bullish. The Envelope technical indicator will be considered later.

For the reliable trend identification, it is recommended to combine several of the listed characteristics, and also to check whether there is confirmation from other trend indicators.

If a trader finds a trend on the graph, this doesn't mean that he should open a position immediately. To find the best entry point, a trader should use particular methods.

Advantages of the DEMA

The main benefit of the DEMA, comparing with the other moving averages, is its efficiency. Due to the double smoothing inherent in the indicator calculation algorithm, it can generate signals in the almost real time.

Conclusions and recommendations

The moving averages are undeservedly ignored by many traders, as the technical analysis indicators. The reason for this attitude is, first of all, their diversity. That's why it's necessary to draw the traders' attention (and especially beginning traders' attention), to the fact that the Double Exponential Moving Average can rightly be considered as a "quintessence" of all the moving averages.

The use of the DEMA as a "sole source" of trading signals is associated with some difficulties. It is more like a "polar star," which is suitable for navigation in the "stormy ocean" of the exchange trade.

English

English

русский

русский