Renko

Renko Candles is a way to represent information about the market condition in the form of blocks of equal size. This tool allows to see the trend formation and to determine significant levels of support and resistance. The main advantage of Renko charts is that they do not show unnecessary noise and provide a common situation in the trending market. What else these Renko charts can show and how to use them in Forex trading is discussed on the MTDownloads website.

What is a Renko Chart?

Renko charts are the oldest method to represent price movements. It first appeared in Japan several hundred years ago. Farmers had to follow the movements of rice prices. However, the problem was that the small parchment did not allow to display a large amount of information. Therefore, Japanese people began to use the new way to represent price movements. A key element was a brick (renga) or a candle.

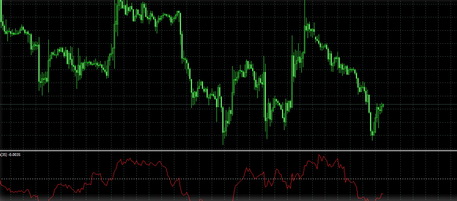

Nowadays, this method is used by traders as a technical analysis tool, which is similar to the Japanese candlesticks graph. Both graphical methods represent elements (candles or bricks) of two colors that show the significant price performance over a given period. Unlike candlesticks, this graph contains fewer candles. It manages to filter out the market noise and minor fluctuations and concentrate on the primary price maneuvers.

Principles of the candles’ formation

Renko charts, as well as Japanese patterns, are of two colors. Dark bricks on the graph suggest that the bears were stronger in this time interval, and the light ones show the superiority of bulls. When the chart starts showing blocks of a different color, it is a signal for an imminent reversal of a trend. Moreover, if the candlestick chart contains the trend or the counter trend signals, the Renko chart will keep the same direction until you see a brick of a different color.

Every candle is formed strictly at an angle of 45 degrees about the previous brick. The smaller the block’s size is, the more bricks there will be on the chart. Therefore, the price movement will be clearer.

When forming Renko patterns, the basis is the close price. In this case, close price is not considered to be the completion of the time interval of trades. It is the moment the price reaches a fixed threshold. For example, you chose the threshold of 10, and the price is around 100. The first brick will be formed at the time when the price reaches 90 or 110. The next block will appear after reaching the level of 80, 120, etc. In this case, the Renko candle will be white if the close price is higher than the open price. Otherwise, it will be black.

Signals of the tool

Simplicity is the main advantage of this tool. His signals are quite clear and unambiguous. If a series of white blocks is followed by at least two candles of black color, it is time to sell. If no less than two white bricks appeared after the black raw, it is time to buy.

However, it is worth considering that its signals can be very late within this graph. Therefore, it is not safe to be guided by solely this tool. It is better to test its signals with other technical indicators (trend indicators or volume indicators.)

Disadvantages of Renko charts

Despite the fact that the Renko charts allow you to see trends more evident, all traders note some problems when working with it:

- Renko patterns suppress volatility smoothing out market noise. Volatility is important to consider to exit the market in case of adverse conditions;

- Depending on the threshold, the brick’s formation takes some time - from several minutes to several hours. During this period, the chart can show the consolidation of sellers or buyers, undesirable reversal of the trend, or corrective price movement. Renko chart does not give such information, and therefore, a trader may miss the moment when the price moves in unfavorable direction;

- In the area of moving averages or other critical levels, bricks of different sizes can alternate and mislead a trader;

- Trend indicators, used to confirm the signals of the tool, can give to anticipating data that often turns out to be false;

- As the bricks appear only after the price reaches a given threshold, the formation of a chart may be delayed for some time. Due to this fact, all difficulties with the relevance of the displayed information appear.

Many traders have noted that Renko charts are appropriate to use for intraday trading, but this indicator is ineffective on the daily charts. Besides, this method is useless if you trade during a flat. Thus, if you are going to practice Renko, be sure to trade with the trend. Also, don't forget to check out the signals with the help of additional technical analysis tools that you can download on the MTDownloads website.

English

English

русский

русский