Experts

Forex experts are specially written computer programs designed for automated trading in the financial markets. Experts analyze charts' indicators to identify trading signals and conduct buy/sell operations of the asset based on these data. These programs actually perform the trader’s work. However, most part of experienced players prefer to trade independently and not to rely on automatic experts. The reasons for it, the pros and cons of trading robots, and methods of their application will be discussed further.

Every successful trader knows one thing: you won't earn money quickly in Forex. Indeed, there are lucky ones, but this is rather an exception. To receive a stable profit in the foreign exchange market, you need to analyze it, follow the world news, and track the asset price movements. As it is seen, it is a laborious process, so various technical tools, such as indicators, scripts, experts, etc. were invented to help traders.

Each of them automates the trade: signals when the price turns prompting the moment to open a profitable order, performs complex operations, or completely replaces the manual trading. The last thing is totally about the experts. If you configure this program correctly, you'll be able to minimize the interference in the trading process and continue to make a profit at the same time.

According to the statistics, almost 90% of successful traders don't sit at computers around the clock and don't monitor the market, they just use the trading bots that do everything for them. Programs have no feelings and emotions, so that they follow the algorithm exactly and do their work, while people have emotional stress, fatigue, etc. - all these things negatively affect the trade efficiency.

What is an expert?

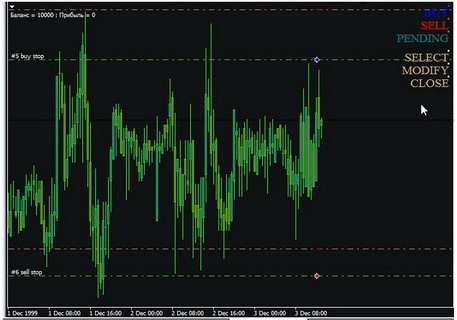

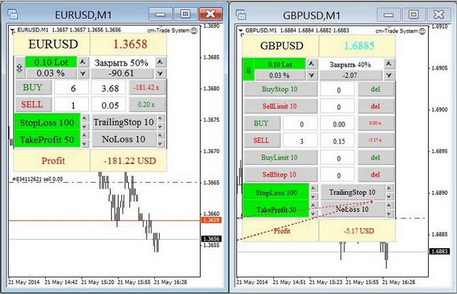

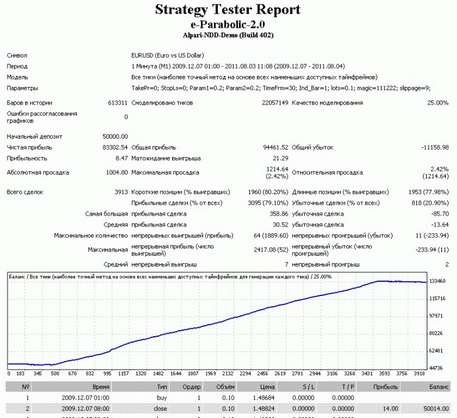

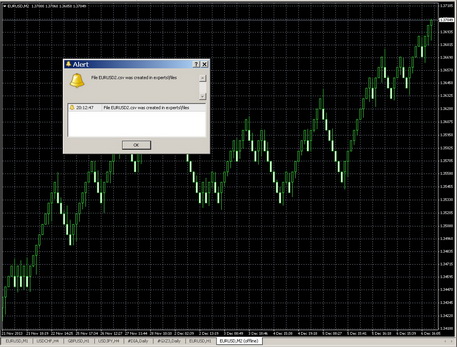

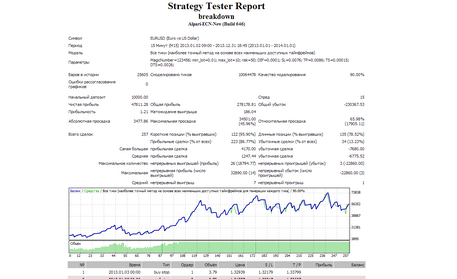

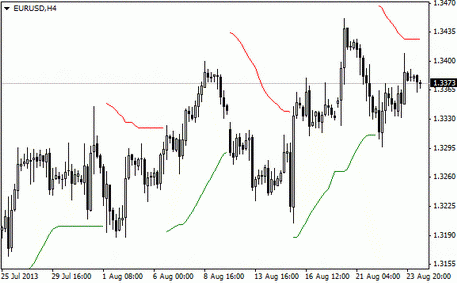

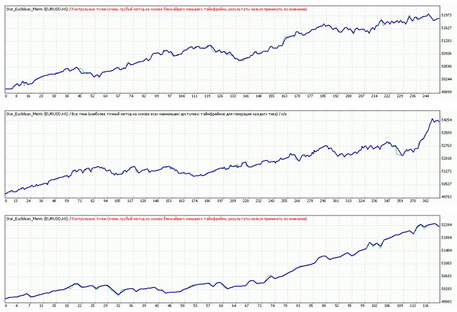

Those who are interested in Forex trading have certainly heard about such a concept as an automated trading. This is nothing more than the result of using the considered trading robots. Experts are programs that are integrated into the trading terminal and monitor market signals. This allows the bot to open a buy or sell order depending on the configured algorithm of the operation. The use of such programs replaces the human job. The most difficult thing here is to adjust the sequence of the experts actions. Considering the robot as a prototype of the trader, it must "think" as a trader. Therefore, a user needs to build a trading strategy first, then test it on a demo or a real account.

nevertheless, the bots have their own built-in algorithm, and many traders use them in their original form. However, experienced currency sellers and buyers set up experts as they want. As a result, robots independently make trading decisions, and it is almost impossible to get loss with the automated trading - the levels of stop-loss and take-profit are necessarily set, otherwise, the robots wouldn't make a sense.

Free trade robots: pros and cons

There are both standard Forex Experts, which have been built in in the trading terminal by default, and purchased ones. The latter have a better functional abilities, and take into account more trading parameters. A wide range of trading robots is available on the MTDownloads website. There you can get acquainted with the functional features of bots, and download the latest robot version for your device or PC, for free.

Novice traders who are not ready to spend a lot of time for trading, but want to make a good money though, traders will need the help of robots. There will be a dilemma: the paid bots or the free ones? I wouldn't want to buy, but would do it if necessary.

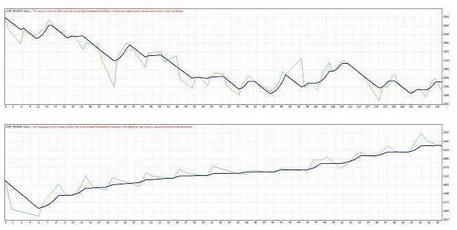

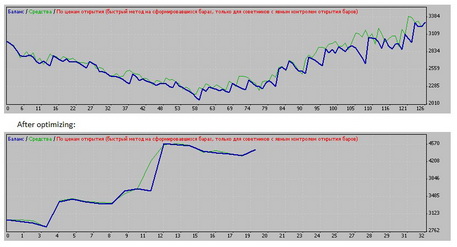

There is an opinion that a free software product has a certain test time, after which the program must be purchased, but it's not always true. As for trading robots, free versions sometimes surpass paid ones. Every year, the development industry increasingly helps traders automate trade by releasing dozens, and even hundreds of bots a month. To turn this into a business, they sell their product. It doesn't mean that the quality of the free trade experts is worse. The only way to test the effectiveness of an expert is to test its work, and, preferably, do it on a demo account.

The bots are available for free on the MTD site, and their number will allow each trader to pick up an assistant they like. Each expert has a lucrative action algorithm developed by the joint efforts of experienced traders, programmers, and analysts. An experts installation to the trading terminal will take several minutes, and the integration procedure is given in details on the website.

Recommendations

Before using the robots, one needs to test it first. Many programs are functionally similar, so it would be useful to read a brief instruction first. At this stage, a trader may find the similar robot, so he won't waste a time in vain. It is important to use different financial instruments, apply the different values for one parameter to understand an expert.

Traders often throw the robot away not revealing even a half of its capabilities. It is worth to watch training videos - this is one of the most common practices in the world.

It is necessary to study the program settings. It's possible that there is a robot that perfectly suits your strategy - then you are very lucky. I must say, this happens only with the beginners, who don't have special demands to the trading process. Experienced traders prefer the multifunctional experts, because they probably know the conditions and even a minute for a price to turn, so they want to configure the algorithm as accurately as possible. It requires more customizable parameters.

English

English

русский

русский