Detrended Price Oscillator (DPO)

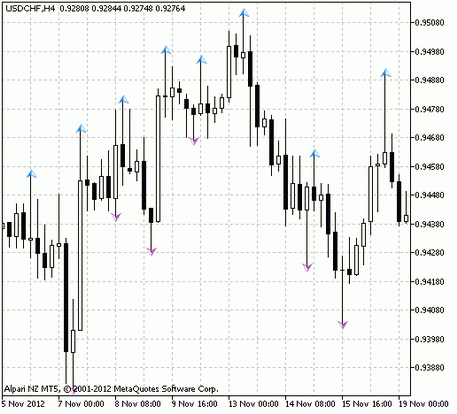

The Detrended Price Oscillator (DPO) is a technical analysis tool, which allows the trader to determine the oversold and overbought areas of the asset and the best time for opening the trading order. For using the latest version of the program, you should download the Detrended Price Oscillator on the MTDownloads website.

Trading in the currency exchange market is complicated, so traders use special programs, which allow to control the price movements and to predict the change of direction. The oscillators are popular technical tools, which work well in flat and allow to determine the appearance of a new trend, as they are excellent moments for entering into the market.

The DPO is one of such assistants for trading. In addition, the tool allows to determine the area of the highest and lowest prices, which are the areas, where you can get super profits. It is worth saying, that trading in these zones is very risky, but it can really bring good money, if to choose the correct moment.

The overview of the indicator

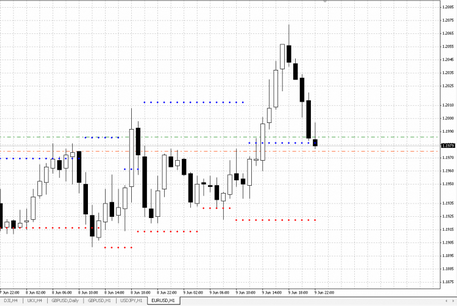

Detrended Price Oscillator's main feature is that it smooths trends by focusing the trader's attention on the main cycles of the price movements. As a result, this tool converts the moving average into a straight line, which fluctuates around the level 0. The DPO graph is displayed at the bottom of the active window.

The tool is used to analyze the short-term price trends. In general, it helps to notice the most important reversals of the long-term cycle, so you can say, that this robot is multi-functional. The algorithm of the program is configured in such way, that it doesn’t simply take into account the long-term price cycles, but it is its "zest", because the analysis of small periods is more effective and informative. The optimal period is 21 or less.

The main characteristics

Due to the fact, that the Detrended Price Oscillator is able to analyze only short periods, its indexes are quite accurate. As a result, the trader can see on the chart all the sharp price fluctuations and it represents the dynamics on the long-term period.

Along with this, the averaging of the values distorts the picture of reality, so analysts prefer to use the DPO with other technical analysis tools. In pair with the moving averages it works fine - this program can be downloaded for free at MTDownloads.

The parameters of the DPO oscillator

When working with a trading assistant, the user can choose two parameters:

- The MA_Period - the number of periods in the cycle analyzed by the program.

By default, this parameter is 14. As we have already said, the robot doesn’t analyze the long-term cycles well, so it is recommended not to exceed 21 in this parameter. If the cycle has more periods, then it is set in the settings and it will be deleted from the price history, but short cycles will remain. This scheme of action allows you to produce the quality signals, reducing the number of false indicators, as most oscillators.

- The BarsToCount - the number of bars in the history of prices.

Here the user can adjust the number of bars, the prices of which will be taken into account when calculating the moving average of the DPO. A standard parameter is 400, as it allows you to achieve full smoothing and maintain the accuracy of the signal. This value isn’t recommended to change, but, of course, you can test other options

If you lower the parameter, it will be easier for the tool to calculate the value and it will increase the accuracy of the indicator's indexes. However, along with this, the program can skip the important points of the trend reversal.

The trading signals

Reading the Detrended Price Oscillator signals is quite simple - it is the main advantage of this trading assistant. The indicator on the graph is displayed as a single line and the key characteristic of its movement is the zero level. Accordingly, if the line crosses the axis from the bottom to the top, then the trend is increasing. If the indicator goes down to the bottom of the chart, it means, that the market has a downward trend.

But, having such information isn’t enough for the accurate opening of the order. It is still necessary to get more accurate signals:

The signal for buying:

- The indicator crosses the central axis from the bottom to the top;

- The indicator is located in the oversold area, which is confirmed by the previous minimums and the line breaks the resistance line of the downtrend.

The signal for selling:

- The DPO tends down through, crossing the zero level;

- The DPO is in the overbought zone and it is confirmed by the previous maximums. In this case, the price and the oscillator break through the level of support of the uptrend.

It is worth noting, that the Detrended Price Oscillator is rarely used to get the trading signals. Usually the traders combine this robot with other indicators. Look through the database of the most popular trading robots on MTDownloads website to find the best pair for your trading strategy.

English

English

русский

русский