Traders Dynamic Index TDI

Trader Dynamic Index or TDI is a composite indicator that combines some known trading robots. It identifies the strength and direction of the prevailing trend in the market as well as the evolution of the asset’s price over a period. Here we will describe Traders Dynamic index and tell you the basic rules to use it for trading. To test and apply the indicator to your strategy, download it for free on the MTDownloads site.

Trading is not just a system for opening and closing orders. A trader should understand its structure and also be guided by mechanisms affecting the price level to get profit in the currency exchange. In brief, you're unlikely to open a profitable trade if you can't predict the value of an asset in the nearest future. As a result, you will at least lose your deposit and suffer severe financial losses at most.

Useful technical instruments should be chosen to ensure successful trading. Thus, it is worth mentioning TDI is one of the most popular trading tools.

Indicator’s characteristics

The market can be studied through fundamental and technical analysis. With the help of the first, a trader understands the events affecting the price change, while the second demonstrates price level fluctuations and signals a trader about appropriate moments to enter the market.

TDI is a technical analysis tool that defines the trend in the currency market, demonstrating its direction and strength. It is considered a standard MetaTrader4 tool, but if you need the latest version of the indicator, it is freely available on the MTD website.

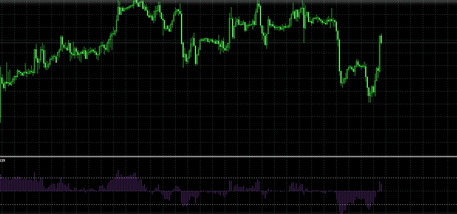

On the chart, TDI is displayed as five lines of different colors, which correspond to separate indicators. The tool is opened in the additional window below the price graph.

What does the line color mean?

Two blue lines represent Bollinger Bands. By default, the period is set to 34, but you can change it manually. A blue color reflects the price volatility of the financial instrument. This indicator also signals all repurchased or resold asset.

The green line operates according to the formula of the RSI indicator; it shows the trend strength and the possible moments of its reversal. It is one of the most popular indicators to work in the trending market. By default, RSI analyzes 13 periods.

The red line is based on the green because it is a moving average RSI. The standard settings check two periods, but you can change this setting manually.

The yellow line is the middle axis, based on all other curves. It shows the overall market trend. If you do not change the calculation settings, the line is based on seven periods’ data.

Trading on TDI signals

Trader Dynamic index is a general indicator that gives a summary of the market price position. It can be applied to almost any strategy. However, you need to learn about its features before you start to use TDI actively.

The red and green lines are to be analyzed to identify the short-term trend. When the red is above the green, the market is on the rise. However, the price of the asset falls if the situation is opposite. You can also use the yellow line to determine the direction of the trend.

The importance of the yellow line is also that it can show the areas of repurchase and resale as well as the points of the reversal. As practice shows, the axis mainly ranges between 32 and 68. Consequently, if the line falls below 32, this indicates a low price. When the indicator returns and crosses the mentioned line, it is a good signal to sell the asset. By analogy, you need to proceed when the yellow line passes the point of 68 from above. Otherwise, open the buy order.

The blue lines, as we said, represent one instrument, so they're worth considering in pairs. When lines diverge, there is a high chance of a strong market trend. When the stripes are too close, it shows low volatility and flat.

Paired use of indicators

In conclusion, we would like to refer to the parallel use of several technical analysis tools. Almost all traders are proponents of this approach, but opinions differ when it comes to TDI. As it produces relatively complex data, a starting trader applies it individually. However, professional traders prefer to confirm the signal of a specifically highlighted indicator with a tool from the same group.

In general, paired use of indicators is a must for every trader. Perfect pair can only be identified through bots’ testing on a particular strategy. Check out the characteristics of the most famous trading robots and download the necessary indicator for free on the MTDownloads website.

English

English

русский

русский