Currency Slope Strength (CSS)

The Currency Slope Strength indicator is a tool that allows estimating the relative currency strength. It's no secret that different currency pairs demonstrate various activities. The movement speed of some pairs is increasing, while others are moving smoothly, without creating significant trends. The Currency Slope Strength indicator allows a trader to accurately determine the most active currency pair at the moment compared to the others.

Initially, this indicator was designed to show the strength of the currency in a pair, but over time it was improved and now is used to measure the power of all the traded currencies, compared to each other. This indicator is easy to use, and its signals can be interpreted without errors. The currency strengthening is displayed on the chart as a deviation from the zero mark. Every time a graph crosses the zero point, it signals a trend reversal.

How does the CSS indicator work?

This tool compares each currency to the others. For example, comparing the Australian dollar to the US dollar, the euro, the British pound, the yen, etc., the picture will change if you exclude the AUD-pairs from the list. For estimating the power of US dollar, the instrument will perform summing the slopes of the currency pairs including the dollar: USD/AUD, USD/CAD, USD/CHF, USD/JPY, USD/GBP, USD/NZD, and USD/EUR. Further, the result is divided by the number of pairs used, and the result will mean the average strength indicator for the USD.

The CSS indicator uses the triple moving average algorithm for calculations and measures the strength depending on the slope of the graph. In the case of a positive inclination angle, the price increases and, in the case of a negative angle, decreases. At the same time, the larger the angle is, the brighter is the price momentum. Under this principle, it is worth considering that a line turn means not a trend reversal, but the speed change of the currency growth:

- If the angle is positive and it increases at the same time, the price growth accelerates;

- If the indicator turns around and tends towards zero, it means a slowdown in the currency growth.

However, this tool does not work with a true angle value but converts it using the built-in algorithms, since the average TMA values would cause the indicator to work slowly. In this case, a trader can note a faster response of the indicator compared to the moving average.

Using the indicator

First of all, a trader should remember that this tool is only able to show the currency advantages. It's not used to measure the market volatility. The market movement after the indicator’s signal can be both minimal or forming a strong trend with the equal probability.

In general, there are several signal types of this indicator. We will describe them below.

Intersection of lines

- If the lines intersect outside the channel, it means that one of the currencies stops growing, and the other one, on the contrary, speeds up. Such an indicator signal is a good chance to open a position since it can be the beginning of an active movement on the market;

- In the case of a line intersection within the channel in the zero-point region, it means that none of the currencies show activity at the moment. This signal is not profitable and can signal the beginning of a new downtrend or an uptrend as well. In this situation, the most reasonable decision will be to wait for the further events;

- If one of the currencies stays inside the channel, and the other stays outside the borders, it means a new trend emerges in the market;

- If one of the currencies broke through the upper boundary of the channel, and the other one goes through the lower one, this signal should be interpreted as preceding to the long trend. In this case, the intersection may occur with a day or a week interval, not simultaneously. A trader should open a position anyway.

Parallel Lines

If both currencies move in parallel, it means the currency pair moves in flat. Do not pay attention to the line direction - the movement occurs both in the upper direction or in the lower one. In this situation, the currency located above on the chart is stronger.

Intersection with the channel boundaries

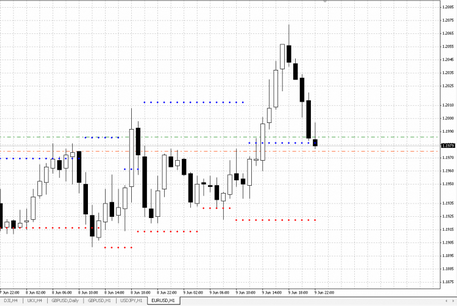

It's worth noting the intersection of +20/-20 is among the primary signals. The indicator signals with the green and red dots, respectively.

A broken channel signals the emerging trend, and, this indicator will help a trader determine which currency can hit the channel most likely as well as predict the price movement direction.

Summary

The CSS indicator allows you to measure the currency strength and, therefore, it's appropriate to work within any trading strategies. This tool can also be used as the main one since the assessment of the currency is carried out at the very beginning of a trend.

This indicator is the fruit of many efforts of the developers improving it, and its convenience will be appreciated by experienced Forex traders as much as by newcomers.

English

English

русский

русский