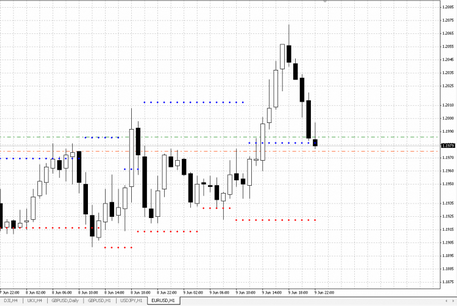

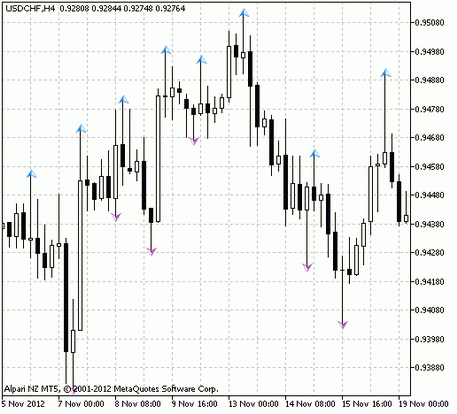

Heiken-ashi candlesticks

The Heiken Ashi Candlesticks Indicator is one of the candle analysis tools. It's not very popular, but each Forex trader shall get acquainted with this tool.

The MT4 and MT platforms, as well as some other trading platforms, contain this indicator in the "basic configuration." It looks similar to the regular Japanese candles. But the principle of their construction is entirely different:

- "Open" point = (Opening point + Closing point of the previous candle) / 2

- "Close" point = (Opening price + Closing price + Minimum + Maximum price) / 4

- "Min" point = the smallest of the point values (Open, Min, Close) on the previous candle;

- "Max" point = the biggest of the values (Open, Max, Close).

In other words, the Heiken Ashi Candlesticks are constructed from the average values. The indicator is automatically generated on the platform and doesn't require any additional settings. The trader is given the opportunity to "clarify" the service details. The following parameters are set when the indicator is started:

- Shadow of bear candlestick (color of the shadow)

- Shadow of bull candlestick (color of the shadow)

- Bear candlestick body (body color of the candle)

- Bull candlestick body (body color of the candle).

This indicator is useful for high-volatile tools. Most often it's used for cross-selling with the participation of the Japanese Yen. By the way, this is one of the few technical analysis indicators, that can generate relatively accurate signals for a GBP / JPY pair, also known as the "dragon." There was a useful indicator use on exotic pairs, but this is already an "extreme" trade

The functional capabilities of the Heiken Ashi Candlesticks indicator

First, this indicator is appropriate only for short-term trading. The relevance of the indicator is sharply reduced over the longer time intervals. It can't be said that it forms false signals, but there are no "good" ones.

Like the vast majority of the candlestick indicators, the Heiken Ashi indicator is not used alone, although many traders will want to argue with me. Sure, there will be some currency traders who are guided solely by the signals of this indicator, making the transactions. It is permissible for the experienced traders, who have learned to "understand" the market, but for beginners, this is completely forbidden.

The primary function of the indicator is to determine the trend direction, and it works well. It signals about the maturing reversals and corrections well. But it's not able to determine the market potential or the depth of corrections.

Trading strategies using the Heiken Ashi Candlesticks indicator

Planning transactions, this indicator is used in close cooperation with the stochastic one. The Heiken Ashi issues the information about the trend direction, and the oscillator informs about the trend potential and the depth of its possible corrections.

Usually, five trading signals generated by the indicator, are observed:

- There is no lower shadow on the "bull" candle. This signal indicates a powerful upward movement. The open short positions should be closed. Open, or hold the previously opened long positions. Similar (reverse directed) actions are performed when there is a "bear" candle without the upper shadow;

- "Bull" candles (usually green) without shadows appear on the graph, either at the origin or the end of an upward trend. Receiving a stochastic signal about an overbought, or an oversold trading instrument, you can open either a long or short position. If there is a full-body "bear" candle, we should act the same way;

- A candle with a short body and long shadows on both sides, warns of a possible turn. It is necessary to wait for the substantial candle; it is also needed to check the oscillator and make a deal in the nascent trend direction.

Advantages and disadvantages of the Heiken Ashi Candlesticks indicator

All the pros and cons of the indicator are based on one of its fundamental characteristics - the indicator lags behind. As a result of the candle formation algorithm (the averaged values use), the signals are delayed.

This feature allows the indicator to output "smoothed" signals. The so-called "market noise" has the least effect on its signals. The indicator is valid on the Yen crosses, which are usually not calm. It would be impossible without the "sluggishness" of the indicator algorithm.

As for the shortcomings, they are obvious. The indicator produces comprehensively verified, accurate signals, but traders are not always managed to use them. It isn't dangerous in short time frames. Even on the most poorly predictable instruments, the signals of the indicator don't go beyond the permissible temporal errors. But even with medium-term trading, the use of the indicator is associated with a high risk.

Conclusions

Considering the expediency of the Heiken Ashi Candlesticks use in trade, it should be noted, that many traders confirm the usefulness of such an application. Due to its "weightedness," this indicator is handy for inexperienced traders. Its use as a sole trading signal generator will be dangerous for beginners, but it is advantageous as a training tool.

English

English

русский

русский