Relative Vigor Index RVI

Relative Vigor Index can't be called a popular technical analysis tool. However, some traders prefer to use the RVI to confirm the signals of other indicators, building a trading strategy. MTDownloads believes that this tool is worthy of attention, at least because it was developed by John Eulers – a successful trader and an unsurpassed technical analysis master. So, we will talk about the Relative Vigor Index, how to apply it in practice, and how it can be used by traders.

The RVI indicator description

The Relative Vigor Index belongs to the class of oscillators. This means that his main purpose is to work in flat. However, the RVI has a feature. It's used to determine the prevailing market trend and assesses how long the price movement will continue in this direction. Thus, the Relative Vigor Indicator is a kind of hybrid, which combines the properties of both the oscillator or the trend indicators.

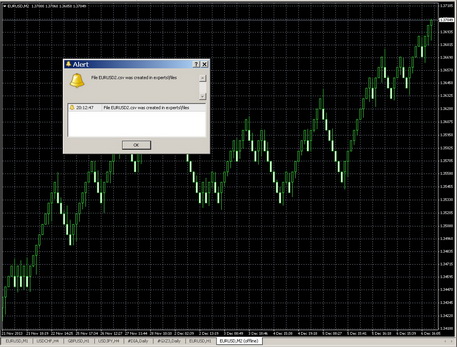

The RVI visually represents two lines, the first one is the signal line, and the other one is the RVI line. Usually the signal line is red, and the RVI curve is green. The green line shows the bulls strength, and the red line shows the bears strength. Thus, if the green line is above the red one, the trader should consider the possibility of the purchase transactions. If the red line is above the green one, then it's advisable to open short positions.

Setting the indicator in MT4, along with the line color, you can also select a period. In the terminal, the default period is N = 10. If you'll select a smaller range, the indicator will be more sensitive to the price changes. This can cause a lot of false signals. If you'll select a longer period, then the number of signals decreases, and they become more accurate, but at the same time, the indicator stops responding to the small corrective movements, which is not suitable for scalping traders.

How does the Relative Vigor Index work?

The principle of the RVI operation is based on the fact that, closing prices in the bulls dominated market are usually higher than opening prices. At the same time, opening prices are usually higher than closing ones on the "bearish" market.

The main indicator buying or selling signals are the intersections of the red and the green lines.

- When the green line crosses the red one, moving upwards, it's better to open a long position and set the stop-loss below the previous local minimum.

- If the red line crosses the green one from top to bottom, then this moment is ideal for the sell orders opening. Stop-loss in this case is set above the previous local maximum.

It should be noted that the signals of the RVI indicator are inaccurate often. To confirm them, it's recommended to use classical oscillators, which include Stochastic, RSI and many others. More information on oscillator indicators you can find on the MTDownloads website.

How to use the RVI and the RSI in tandem

The Relative Vigor Index was developed on the basis of the popular RSI oscillator. However, the RVI schedule is not limited to the overbought and oversold zones. This feature makes it possible to use it not only as an oscillator, but also as a trend indicator. At the same time, the absence of the signal zones makes the signals of the RVI indicator less precise.

The use of the RSI and the RVI indicators in the kit will help to correct the situation. If you use the RSI, then the overbought and oversold zones (zones above the level of 70% and 30% respectively) will appear on the graph. Now you only need to monitor the price movement and fix the moments when it enters the one of these zones, and compare the obtained data with the indicator.

For example, we see that the RSI line broke through the level of 70%. At the same time, the green line crossed the red one from top to bottom on the RVI graph, signaling that it was a time to sell. Reaching the overbought zone with the RSI indicator shows the same – the bulls are exhausted, and so the price will fall soon. Thus, the signals of both indicators coincided, and we can be sure that we'll be able to sell the asset at the best price opening a short position now.

Disadvantages of the RVI indicator

The Relative Vigor Index has the same drawbacks as most of the oscillators. It gives a large number of false signals for sale in the presence of an uptrend, and as many false purchase signals, when the market is dominated by a downward trend. Thus, we can conclude that trading on the RVI indicator signals is better in the trend direction, to avoid undesirable losses.

In addition, the Relative Vigor Index is practically useless, if we build trade on its parameters solely. Traders who work with this indicator, including its creator, give an advice to use the RVI only as an auxiliary tool, but not the main one. Nevertheless, some traders state that the Relative Vigor Index is a good alternative to even such a popular technical analysis tool as the stochastic. To see if RVI is suitable for your trading style, we offer a free indicator download on the MTDownloads website.

English

English

русский

русский