Schaff Trend Cycle

Schaff Trend Cycle is a tool based on the technical forecasting indicators such as Stochastics and MACD. As an oscillator, the Schaff indicator is devoid of the main drawback of almost all the representatives of this group - it doesn't generate false signals, working on the trend market. It makes it a handy tool for the price movement forecasting. Therefore, it's useful for each trader to have the Shaff Trend Cycle among the arsenal of the trading platform. Further, you will learn more information about what does this tool represent and how to apply it in practice.

How does the Schaff indicator work?

The creator of such a tool, Doug Schaff, who is the founder and the head of the FX Srtategy, drew a special attention to the shortcomings of a lagging stochastic and advanced MACD indicators. He derived a formula that is able to smooth out those data. He was based on the theory of the cyclical nature of the market processes. As a result, Mr. Schaff succeeded in developing an indicator that absorbed the properties of both oscillators and trend analysis tools. Now this tool is called the "Shaff's Trend Cycle".

Mr. Schaff noted that the reason of the stochastic lagging, as well as the MACD wrong signals, is the parameters used to calculate the indications. Therefore, Mr. Schaff increased the frequency of calculating the exponential moving average from 12 and 26, to 23 and 50, which reduced the number of false signals. Further, he added a cyclical parameter, based on the 10-day interval, and eventually received an indicator that was devoid of the main shortcomings of its predecessors.

The Schaff Trend Cycle doesn't fail when the price enters the oversold or the overbought zone. It works great both on the trend market or within the flat. And it really is a tool that allows you to predict the price maneuvers in advance, which is most important.

Indicator settings

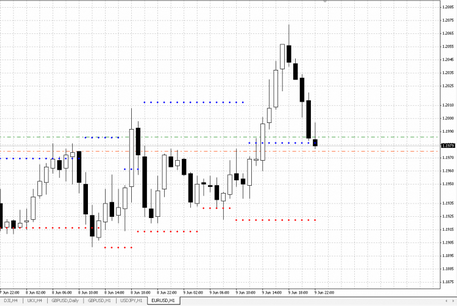

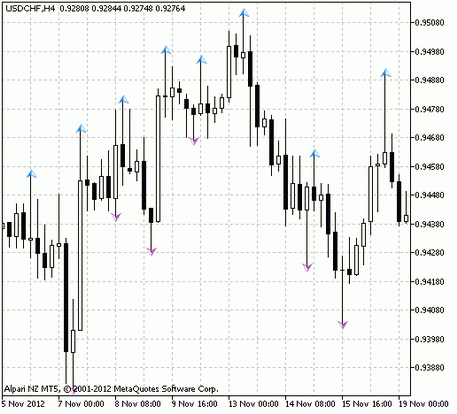

On the graph, the Schaff indicator is represented as a signal line that moves within the limits of the overbought and oversold zones.

The settings of such a tool include three main parameters:

- MAShort is the period for the fast moving average, which is one of the two variables used calculating the MACD indicator. By default, this parameter is set to 23;

- MALong is a period for the slow moving average, which is also involved in the MACD calculation. The value of such a parameter should always be higher than the MAShort value. The default value is 50.

- Cycle - the duration of the market cycle, which equals 10 by default. This parameter is the stochastic part of the Schaff tool. It's calculated twice, which allows you to smooth out the readings and so achieve more accurate calculations.

In addition, you can specify the overbought and oversold zones in the settings. Standard settings include values of 25/75. Some traders prefer to use 80 and 20 as signal levels, considering this necessary for the Schaff to become more sensitive to the price movements.

How to use the Schaff indicator?

First of all, the Schaff Trend Cycle is an oscillator. Therefore, the easiest way is to start trading when the signal line crosses the overbought or the oversold zone. Crossing the level of 75 from the top to bottom is a sell signal, and if the signal line breaks through the level of 25 and rebounds from it, it's time to set a buy order.

Doug Schaff suggests a more complex version of the use of his invention, based on a combination of the indicator readings and the candle analysis as well. It helps to increase the efficiency significantly. The trading algorithm is as follows:

Signal for purchase:

- Fix the moment when the signal line crosses the level of 25 from the bottom to top.

- Wait for the current candle to close, and check the formation of the next one - the closing price should be higher than the maximum value of the previous candle.

- When all these conditions are met, open a long position.

Signal for sale:

- Wait for the moment when the signal line crosses the level of 75 from top to bottom.

- Next, look for the formation of the current candle and the next one - the closing price of the next candle should be lower than the minimum of the previous candle.

- If all of these conditions are met, you can open a short position.

There are other options of the Schaff tool to find the most successful entry point to the market. For example, you can use them in combination with the reversal patterns of the Japanese candles.

The Schaff Trend Cycle provides quite accurate signals, regardless of the market conditions. The advantage of such a tool is also its simplicity. This makes it an entirely practical tool for the technical analysis and explains its huge popularity among the traders. You can see yourself, how simple it is, and how accurate are the trading signals of the Schaff indicator, by downloading it on the MTDownloads website.

English

English

русский

русский