Volumes

The volume indicator is the tool of technical analysis, which shows the number of opened and closed transactions on the selected time frame for a particular financial instrument. This tool is also called the Volume indicator. It is one of the standard robots, which can be found on the MetaTrader4 platform. Many traders use it, both separately and combining it with the other tools of technical analysis.

What is Volume?

Before starting to trade with this tool, it is necessary to understand fully, what is “the volume” in the world market.

The volume (in this case) is the number of opened and closed transactions on the selected timeframe. If we talk about this concept in the world market, we can divide it by the futures volume and the teak volume.

To calculate the volumes in the stock exchange market is quite simple. For example, if ten lots of a financial instrument were bought or sold for 1 hour, then the instrument's indicators for this hour will be 10,000. It is how the futures volume is calculated. However, in the foreign exchange market, it is estimated much more challenging. In this case, in the process of calculating, the main characteristic of the Forex market, the high volatility, is taken into account. That’s why, in the heart of this indicator lays the price fluctuations, which are also called tics. For example, if for the period of half an hour, the price has been changing 50 times, then the indicator of the technical analysis for these half an hour will also be 50.

Trading with the indicator of volume

To start trading using the Volume indicator, you need to download it for free from the MTDownloads website.

This tool of technical analysis is used to calculate the strength of the trend, to determine its truth, the probability of the breakthroughs in flat and to predict the turns. It is effortless to use it:

- When the indicator of Volume grows - the bullish trend intensifies;

- When the indicator of Volume falls - the bearish trend increases;

Usually, the indexes of this indicator start to change dramatically, when the important world news is released, and that’s why it isn’t worth neglecting the fundamental analysis if you have chosen a robot Volume to help you in your trading process.

Even a novice trader can trade using a volume indicator. You just have to understand two main tips:

- If the prices fall or rise and the robot's indexes grow, the trend will get stronger. So we have two choices: if the trend is bullish (upward), then you need to buy the asset, and if the trend is bearish (downward) - to sell it;

- If prices fall or rise, and the robot's indexes are falling, you should expect a reversal shortly.

In addition to all the signals mentioned above, which can be used by any trader in his work with this robot, there are also additional ones. For example, this tool is often used with other indicators or oscillators such as the levels of support and resistance. Together these robots can accurately predict the probability and the time of the break in the flat. This tandem is indispensable in trading.

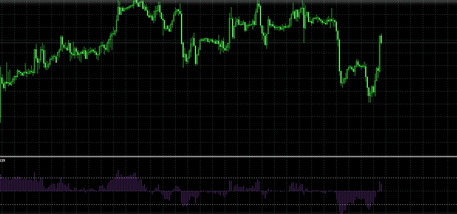

How the indicator of Volume looks on the graph

One of the most unusual characteristics of this robot is that it can be displayed in the entirely different ways on the chart: as a line, as candles or as a histogram. If you use the platform Metatrader4, then by default you will see this indicator in the form of a candlestick chart. You can choose in options any color of the candles, but first, you will see them in red and green.

- Red candle - means, that the selected timeframe had more fluctuations than the previous candle;

- Green candle - means, that on the selected timeframe, there were fewer fluctuations than on the previous candle.

Each candle is equal to the period, which you have chosen. For example, if you set up a 5-minute timeframe, each candle will represent the volume indicators for 5 minutes, and the schedule will also be updating every 5 minutes.

In MetaTrader, you can find the indexes of this Expert Tool in a separate window, which is always below the chart of the price changes of the instrument.

The Disadvantages of the Volume

Despite the universality of this tool, the indicator of volume has the following drawbacks:

- The fluctuations, which are correcting the current value. That’s why, there is no stability and it 's hard to trace the further behavior of the price;

- Failures, which are typical for many indicators and are observed on the large timeframes.

In general, it is better to choose small timeframes, which will ensure the security of your trading.

If you don’t like the standard indicator of Volume, you can choose its more advanced version, Better Volume, which is suitable for those, who are disappointed in the Volume. It is worth noting that the standard tool has more fans than opponents.

Anyway, each trader should have in his arsenal such a tool of technical analysis, like Volume, which can be downloaded on the MTDownloads website.

English

English

русский

русский